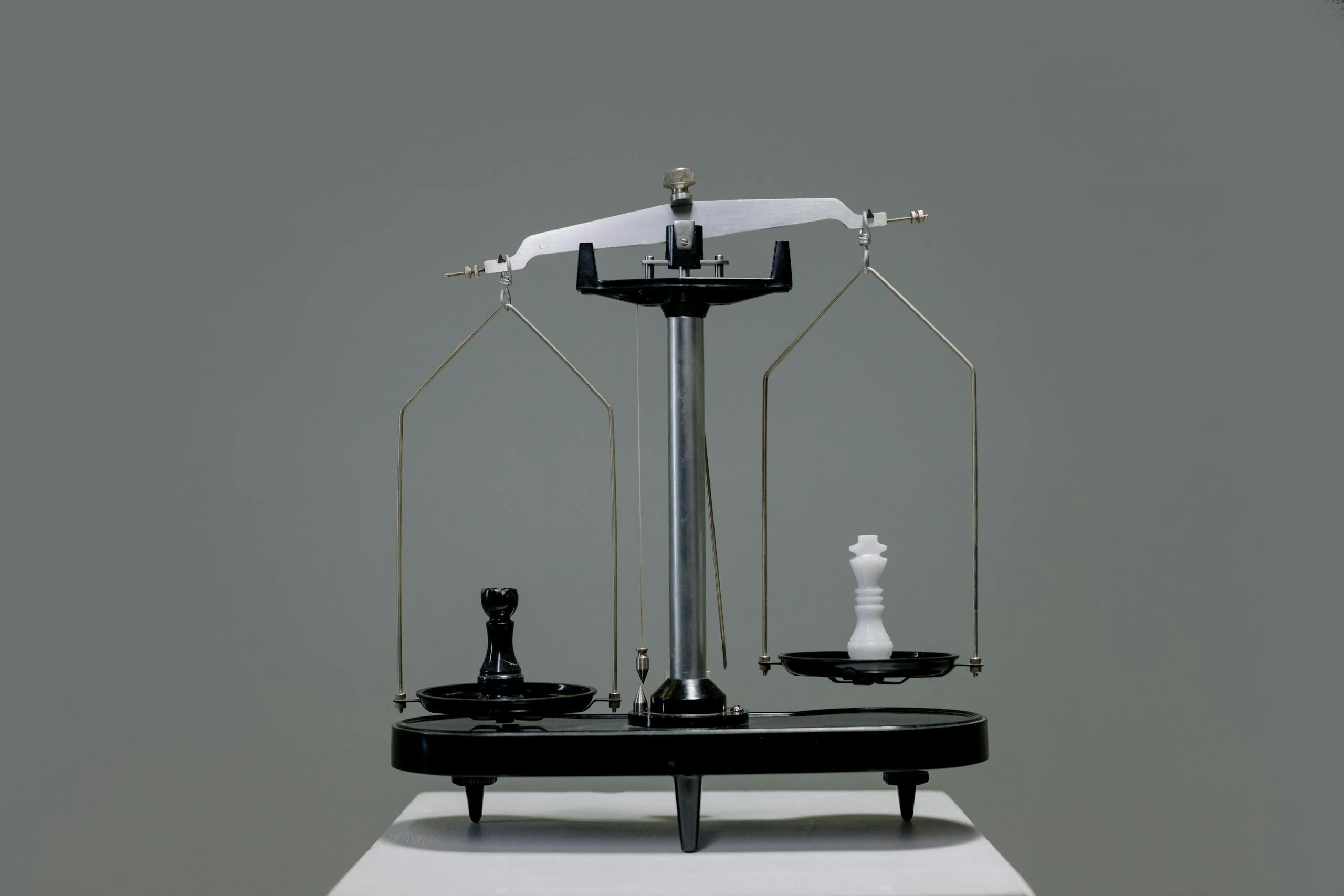

Public Liability vs. Professional Indemnity Insurance: Key Differences

Choosing the right insurance coverage is crucial for protecting your business from potential risks. Two of the most commonly confused types of business insurance in Australia are public liability insurance and professional indemnity insurance. While both provide financial protection, they serve different purposes and apply to different situations. This guide explains the key differences to help you determine the right coverage for your business.

What is Public Liability Insurance?

Public liability insurance protects businesses against claims for injury or property damage caused to third parties due to business activities. This insurance is essential for businesses that interact with the public, such as retail stores, cafes, construction companies, and event organisers.

Key Features of Public Liability Insurance:

- Covers legal costs and compensation for third-party injury or property damage.

- Protects against incidents occurring on business premises or due to business activities.

- Required by many industries and often a contractual requirement.

- Does not cover claims arising from professional advice or service errors.

What is Professional Indemnity Insurance?

Professional indemnity insurance provides coverage for businesses and professionals who offer advice, consultation, or services. It protects against claims of negligence, errors, or omissions that result in financial loss for clients.

Key Features of Professional Indemnity Insurance:

- Covers legal costs and compensation for financial losses due to professional mistakes.

- Essential for consultants, accountants, architects, healthcare professionals, and lawyers.

- Required by many regulatory bodies and industry associations.

- Does not cover physical injury or property damage unrelated to professional services.

Key Differences Between Public Liability and Professional Indemnity Insurance

| Feature | Public Liability Insurance | Professional Indemnity Insurance |

|---|---|---|

| Coverage Focus | Third-party injury or property damage | Financial loss due to professional negligence |

| Who Needs It? | Businesses with physical interactions | Professionals providing advice or services |

| Typical Claims | Slips, trips, and falls on business premises | Errors, omissions, or incorrect professional advice |

| Legal Requirement? | Often required for business operations | Mandatory in certain professions |

| Policy Exclusions | Does not cover professional mistakes | Does not cover third-party physical injuries |

Which Insurance Does Your Business Need?

- If you interact with customers or the public on-site, public liability insurance is essential to protect against claims of injury or property damage.

- If you provide professional advice or services, professional indemnity insurance is necessary to safeguard against claims of negligence or errors.

- Some businesses may need both types of coverage to ensure complete protection.

Conclusion

Understanding the differences between public liability and professional indemnity insurance can help businesses choose the right coverage. Both types of insurance provide essential protection against legal and financial risks but apply to different scenarios.

Get the Right Coverage with Sirius Insurance

At Sirius Insurance, we help Australian businesses find the right insurance solutions. Whether you need public liability insurance, professional indemnity insurance, or both, we can tailor a policy to meet your specific needs. Contact us today for expert guidance and a personalised quote.